| Traded Instrument | Corn Futures |

| Average Annual Net Profit | $ 8833 |

| Average Monthly Net Profit | $ 747 |

| Max Historical Drawdown | $ 6083 |

| Sugested Minimal Capital | $ 14000 |

| Traded since | 7 / 2019 |

| Monthly fee | $ 75 |

Koronas

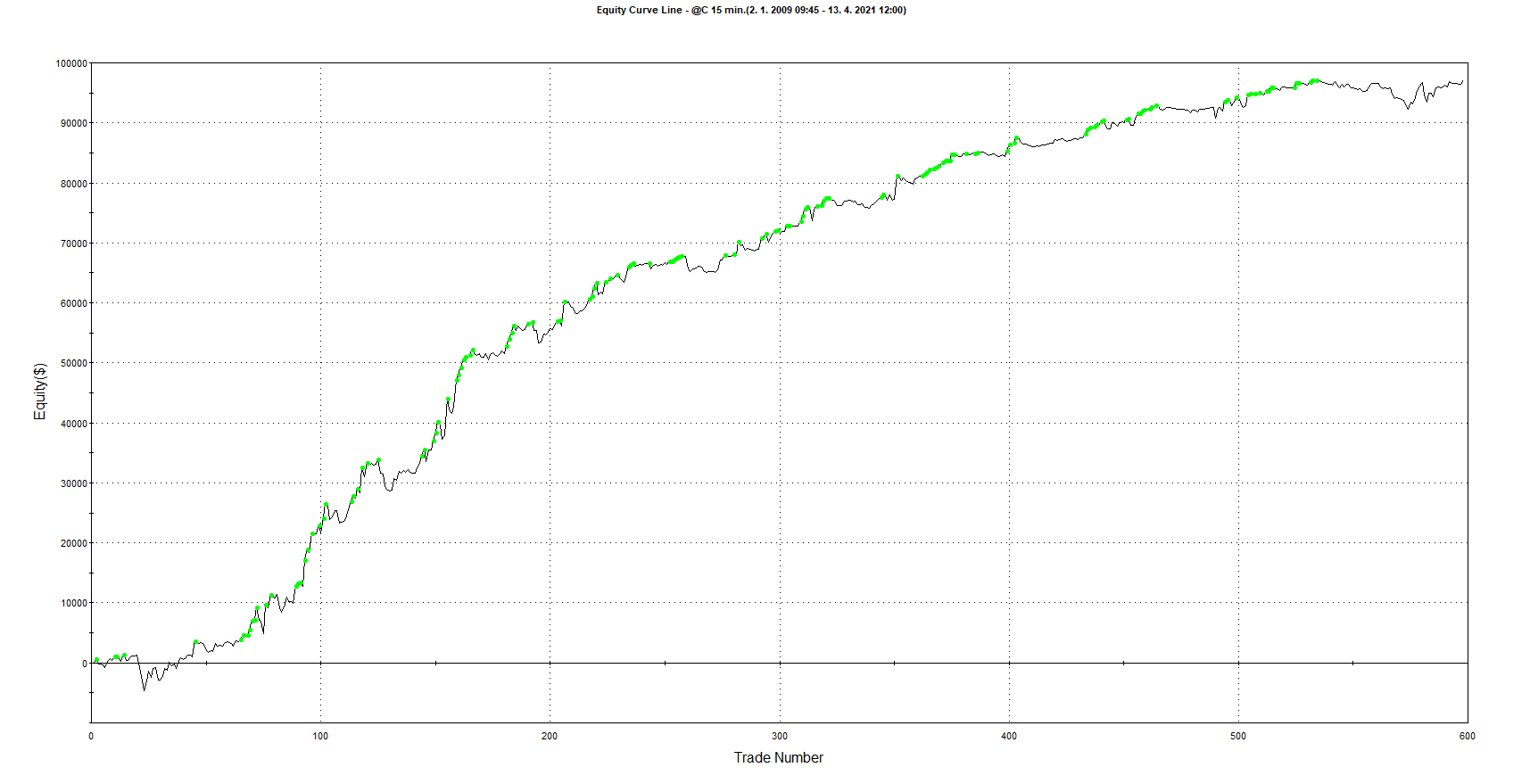

The presented final equity as well as all presented results are traded with one contract and incorporate transaction costs and slippage of $30 RT

This automated trading system can be part

of your balanced automated portfolio.

Koronas is very robust swing trading system which was developed to trade Corn Futures. It also performs well on several other markets and market sectors (e.g. indices, bonds, …).

It generates stable returns in long term with minimal drawdowns.

It is fully automated strategy and after setting up it is possible to trade absolutely hands free. Basically, it trades 1 contract of Corn futures. Each trade has stoploss protection.

Kron was developped in summer 2019 and successfully passed extensive and rigorous stress and robustness testing and prooved strong robustness and ability to adapt and generate profits on changing markets.

It was developed by professional money manager with more than 10 years trading experience. In development process he combine strengths and best practices from different concepts: „idea first“ and machine learning. Together with combination of experience in discretionary trading and ATS portfolio management with math background creates unbeatable synergy.

Below you can find Performance results updated on monthly basis.

Since 7/2019 are results simulated as live trading.

Presented results are traded with one contract and incorporate transaction costs and slippage of $30 RT. Subscription fee is not deducted in simulated results.

TradeStation Account

If you have TradeStation account activation strategy on your account is very easy.

Just click on light blue button above, which link you to TradeStation TradingApp Store. Than just click on “Free Trial” or “Subscribe” option.

Please read carefully guidelines which you find on strategy page on TradingApp Store.

Autotrade this Strategy at Some of Supported Brokers

We are able to arrange autotrade this system at any of supported brokers via our partner Striker Securities.

If you have live trading account at one of supported brokers process is easy.

Just click on light green button above, and send us message to which system/s are you interested in. We will contact you with instructions how to proceed to activate this autotrading mode.

Hypothetical Performance Results Have Many Inherent Limitation, Some Of Which Are Described Below. No Representation Is Being Made That Any Account Will Or Is Likely To Achieve Profits Or Losses Similar To Those Shown. In fact, There Are Frequently Sharp Differences Between Hypothetical Performance Result And The Actual Results Subsequently Achieved By Any Particular Trading Program. One Of The Limitations Of Hypothetical Performance Results Is That They Are Generally Prepared With The Benefit Of Hindsight. In Addition, Hypothetical Trading Does Not Involve Financial Risk, And No Hypothetical Trading Record Can Completely Account For The Impact Of Financial Risk Of Actual Trading. For Example, The Ability To Withstand Losses Or To Adhere To A Particular Trading Program In Spite Of Trading Losses Are Material Points Which Can Also Adversely Affect Actual Trading Results. There Are Numerous Other Factors Related To The Markets In General Or To The Implementation Of Any Specific Trading Program Which Cannot Be Fully Accounted For In The Preparation Of Hypothetical Performance Results And All Which Can Adversely Affect Trading Results. These Performance Tables And Results Are Hypothetical In Nature And Do Not Represent Trading In Actual Accounts.

This website serves to present the results of our research and the trading systems developed by us. The presented information does not serve as investment or trade recommendations. Quantum Financial s.r.o. (Ltd.) is not a licensed asset manager, broker, or an investment advisor. Stock trading and investment involving financial instruments (and commodities in particular) is highly risky. The decision to trade commodities and shares is an individual’s sole responsibility and they themselves shall be fully responsible for their decisions.

Get the Most from Systems trading and Benefit from Portfolio of Trading Strategies

Well diversified portfolio of trading systems is the best way how to get most from trading.

TOP benefits you can get from trading portfolio of strategies are:

► 6-8 times higher risk-adjusted profit

► Over 86% positive months and 98,5% positive quarters

► up to 35% more of positive months than single strategy

► much more stable results